Notice is hereby given that I shall, commencing on February 18, 2020, sell at public on-line auction the tax liens on real estate herein-after described, unless the owner, mortgagee, occupant of or any other party-in-interest in such real estate shall pay to the County Treasurer by February 13, 2020 the total amount of such unpaid taxes or assessments with the interest, penalties and other expenses and charges, against the property. Such tax liens will be sold at the lowest rate of interest, not exceeding 10 per cent per six month’s period, for which any person or persons shall offer to take the total amount of such unpaid taxes as defined in section 5-37.0 of the Nassau County Administrative Code. Effective with the February 18, 2020 lien sale, Ordinance No. 175-2015 requires a

$175.00 per day registration fee for each person who intends to bid at the tax lien sale. Ordinance No. 175-2015 also requires that upon the issuance of the Lien Certificate there is due from the lien buyer a Tax Certificate Issue Fee of $20.00 per lien purchased.

Pursuant to the provisions of the Nassau County Administrative Code at the discretion of the Nassau County Treasurer the auction will be conducted online. Further information concerning the procedures for the auction is available at the website of the Nassau County Treasurer at:

https://www.nassaucountyny.gov/526/County-Treasurer

Should the Treasurer determine that an in-person auction shall be held, same will commence on the 18th day of February, 2020 at the Office of The County Treasurer 1 West Street, Mineola or at some other location to be determined by the Treasurer.

The liens are for arrears of School District taxes for the year 2018 – 2019 and/or County, Town, and Special District taxes for the year 2019. The following is a partial listing of the real estate located in school district number(s) 203, 6, 4 in the Town of Oyster Bay only, upon which tax liens are to be sold, with a brief description of the same by reference to the County Land and Tax Map, the name of the owner or occupant as the same appears on the 2020/2021 tentative assessment roll, and the total amount of such unpaid taxes.

IMPORTANT

THE NAMES OF OWNERS SHOWN ON THIS LIST MAY NOT NECESSARILY BE THE NAMES OF THE PERSONS OWNING THE PROPERTY AT THE TIME OF THIS ADVERTISEMENT. SUCH NAMES HAVE BEEN TAKEN FROM THE 2020/2021 TENTATIVE ASSESSMENT ROLLS AND MAY DIFFER FROM THE NAMES OF THE OWNERS AT THE TIME OF PUBLICATION OF THIS NOTICE. IT MAY ALSO BE THAT SUCH OWNERS ARE NOMINAL ONLY AND ANOTHER PERSON IS ACTUALLY THE BENEFICIAL OWNER.

Town of Oyster Bay

School:

4 Locust Valley

|

Name Parcel |

Group Lot | Amount |

| WINSTON EVE STRAUSMAN | 58,252.48 | |

| 23 B 03640 | ||

| MAYROCK ISIDORE | 25,071.40 | |

| 23 K 05350 | ||

| GRACE JOSEPH & KRISTEN | 36,524.75 | |

| 23 K 05860 | ||

| CIARDULLO JR FRANK J | 65,264.96 | |

| 23 K 06870 |

687 |

|

| CREEDON SHAWN & CORINNA | 12,728.49 | |

| 23 K 07050 | ||

| STRECKER DAVID R & LILLA M | 34,317.04 | |

| 23014 02140 | ||

| MAXWELL J & HANNE | 1,226.90 | |

| 23070 0008A | ||

| LOEBER L E K LOEBER,ETAL,G G | 12,156.75 | |

| 29 D 09890 | ||

| FELDMAN GILBERT TRUST | 2,326.85 | |

| 29 K 00070 | ||

| FELDMAN GILBERT TRUST | 11,933.84 | |

| 29 K 03110 | ||

| DELROSARIO JUSTIN & DANA SCHILLER | 29,243.21 | |

| 29 M 14050 | ||

| SABIO JED & LORRAINE | 16,793.41 | |

| 29 M0101070 | ||

| CAMPANELLA WILLIAM & PATTI | 904.01 | |

| 29 N 00550 | ||

| TREPETA LIVING TRUST | 28,339.13 | |

| 29 R0102620 | ||

| KEENEY WILLIAM & DANIELLE | 16,862.35 | |

| 29 R0211580 | ||

| US BANK TRUST NA TRU | 2,370.21 | |

| 29001 00230 | ||

| HANLEY ROBERT & PATRICIA | 9,781.78 | |

| 29002 00290 | ||

| GILLESPIE STEPHEN | 15,542.30 | |

| 29036 02100 | ||

| O T S ASSOCIATES INC | 595.91 | |

| 29039 03130 | 313-321 | |

| MICRO LEASING | 2,089.05 | |

| 29039 03270 | 327-331 | |

| WEISSMAN BARRY | 2,089.05 | |

| 29040 03340 | 334-338 |

Town of Oyster Bay

School:

4 Locust Valley

|

Name Parcel |

Group Lot | Amount |

| MICRO LEASING | 2,136.73 | |

| 29040 03480 | ||

| ARORA SEEMA & ARUN | 12,032.49 | |

| 29078 00040 | 4 | |

| SCHNEIDER SCOTT & AMANDA | 15,673.99 | |

| 30 E 00120 | ||

| IOCHENG VERONICA WU & IP | 3,421.33 | |

| 30 E 02060 | 206,217 | |

| ZAJJS-518 LLC | 19,940.24 | |

| 30 E 02670 | ||

| MC CULLY ROBERT | 16,381.59 | |

| 30 F 03370 | ||

| ESPOSITO WILLIAM A & KIEM | 46,722.02 | |

| 30 F 03540 | 354-355 | |

| 142 SMR LLC | 38,552.34 | |

| 30 G 04100 | ||

| SIEGEL WENDY | 8,883.95 | |

| 30 H 06180 |

BOGART JR ADRIAN T & LIOUDMILA ILINICHNA 2,716.62

30 K 01610

GRIER PHYLLIS 13,128.99

30009 01780

| PANOPOULUS MARY | 178-179 | 12,330.35 |

|

30012 00280 MOLLITOR NICHOLAS B LIFE ESTATE |

28-31 |

2,083.85 |

|

30013 01260 AGUADILLA LTD |

126-128 |

10,011.22 |

|

30022 00300 BROWN GRAHAM LIFE ESTATE |

30-31 |

10,190.63 |

|

30022 00480 BROWN JOSEPH |

48-49 |

24,352.99 |

|

30022 00500 BROWN JOSEPH |

1,564.84 |

|

|

30022 00570 ZAND LLC |

57-58 |

35,798.58 |

|

30027 01100 PETRUZZIELLO L E L PETRUZZIELLO,R |

110-112 |

4,096.46 |

|

30030 00770 DOLAN REAL ESTATE HOLDING CORP |

77-78 |

8,296.41 |

|

30033 00320 DEARING GERALD |

32-33 |

18,004.41 |

| 30045 00150 | 15-17 |

Town of Oyster Bay

School:

4 Locust Valley

|

Name Parcel |

Group Lot | Amount |

| SAND RICHARD & JAYNE | 49,985.87 | |

| 30059 00090 | 9 | |

| MORTIMER DONNA | 5,046.88 | |

| 30059 00270 | 27 | |

| MEIER DOROTHY & FRED | 6,374.18 | |

| 30066 00110 | ||

| WANG FEI | 20,376.91 | |

| 30086 00240 |

Town of Oyster Bay

School:

6 Bayville

|

Name Parcel |

Group Lot |

Amount |

| CASACCIO SCOTT & CZNADEL WILLIAM | 13,965.15 | |

| 28004 00280 | 28-30 | |

| MUZIO RUTH | 1,323.63 | |

| 28004 00450 | ||

| MEDCOR HOLDING CO | 1,323.63 | |

| 28004 00460 | ||

| MEDCOR HOLDING CO | 1,362.10 | |

| 28004 02380 | 238-239 | |

| COLEMAN CAROLYN | 3,579.75 | |

| 28008 00090 | 9-10 | |

| MYFOUR REALTY LLC | 4,109.57 | |

| 28013 00010 | 1-4 | |

| FURTHNER LUDWIG | 22,604.85 | |

| 28015 00360 | 36 & 37 | |

| PETROVEC JOHN | 3,970.95 | |

| 28022 00970 | 97-98 | |

| VELLA MAUREEN | 1,359.94 | |

| 28041 01650 | 165-166 | |

| SCORES DOLORES A LIFE ESTATE | 5,571.27 | |

| 28046 02210 | 221-224 INC | |

| VALDERRAMA ROBERT & AMANDA | 11,646.45 | |

| 28047 01870 | 187-188 | |

| 33 HILARY LLC | 10,214.91 | |

| 28070 00190 | ||

| TESORIERO ANDREW & CATERINA | 13,465.08 | |

| 28074 00140 | 14 | |

| MARINGELLI ANGELA | 10,130.04 | |

| 28074 00380 | 38 | |

| 22 BAYVILLE AVENUE LLC | 21,587.50 | |

| 29 D 00100 | 10-15,21-26 | |

| BAYVILLE ON THE SOUND ONE, LLC | 15,827.83 | |

| 29 D 01230 | ||

| PENNYMAC HOLDINGS LLC | 1,977.18 | |

| 29 D 03050 | 305-306 | |

| KELLY PADRIC M & JOAN | 12,350.09 | |

| 29 D 03180 | 318-319 | |

| VITERITTI ANGELO | 379.93 | |

| 29 D 10820 | ||

| EW HOWELL CO LLC | 7,539.42 | |

| 29 D0200330 | 33-35,164 | |

| CARAMICO LYNN | 2,948.21 | |

| 29 D0700240 | 24-26 |

Town of Oyster Bay

School:

6 Bayville

|

Name Parcel |

Group Lot | Amount |

| ALLARD WILLIAM J LIFE ESTATE | 5,459.43 | |

| 29 D0800070 | 7,8,73 | |

| BAYVILLE ON THE SOUND ONE LLC | 11,349.80 | |

| 29 D1200010 | 1-4 | |

| REISIGER GREGG & CATHERINE | 22,809.95 | |

| 29 G 00180 | ||

| REISIGER GREGG & CATHERINE | 1,150.48 | |

| 29 G 01180 | ||

| HAIM GABRIEL & CHRISTINE | 4,090.22 | |

| 29009 03530 | ||

| DEBORAH GELFMAN TRUST | 2,088.29 | |

| 29012 00830 | 83-84 | |

| DEBORAH GELFMAN TRUST | 437.24 | |

| 29012 01630 | ||

| OHARA MARY | 6,511.32 | |

| 29013 00390 | 39-42 | |

| CASTRIOTA GEORGE & STELLA | 17,503.69 | |

| 29013 02560 | ||

| AZEVEDO BUILDERS INC & | 13,683.02 | |

| 29014 02360 | 236-238 | |

| SCHULTZ PETER J & DAVID J | 9,125.53 | |

| 29014 02390 | ||

| COLEMAN JAMES & BARBARA | 16,580.58 | |

| 29017 00660 | ||

| JORDAN MICHAEL & JUDITH | 1,275.13 | |

| 29023 05260 | ||

| GALANEK RICHARD & ELIZABETH | 3,451.34 | |

| 29028 00110 | 11-12 | |

| FINN WILLIAM G | 10,779.81 | |

| 29028 00250 | ||

| JONES JAMES & JENNIFER | 1,530.08 | |

| 29028 02130 | ||

| BEBRY JANET | 1,426.15 | |

| 29033 01150 | ||

| PORRELLO MARY | 14,759.99 | |

| 29054 03580 | ||

| KEEFER PAMELA | 12,403.95 | |

| 29062 00780 | 78 & 141 | |

| VUDRAG DELLA J & PAUL L & | 13,247.13 | |

| 29065 00290 | 29-31 |

GOVONI MARIANNE & DANGELO DOUGLAS 8,640.41

29065 00340 34-36

Town of Oyster Bay

School:

6 Bayville

|

Name Parcel |

Group Lot | Amount |

| YONKERS SUSAN J | 2,551.78 | |

| 29077 00130 | 13 | |

| BAYVILLE ON THE SOUND ONE LLC | 28,508.47 | |

| 29082 00020 | 2 | |

| BAYVILLE ON THE SOUND TWO LLC | 18,388.34 | |

| 29082 00140 | ||

| STRECKER DAVID R | 25,643.39 | |

| 29083 00320 | ||

| PUMA JOHN & JENNIFER | 13,617.34 | |

| 29093 00270 | ||

| DELANEY HENRY | 7,488.88 | |

| 29101 00020 | ||

| GIANETTI JOHN F | 15,567.73 | |

| 29104 00340 |

Town of Oyster Bay

School:

203 Roslyn UFSD

Name

Parcel Group Lot Amount

SNACKMAN REALTY LLC 5,780.74

20 N 0764A

TERMS OF SALE

Such tax liens shall be sold subject to any and all superior tax liens of sovereignties and other municipalities and to all claims of record which the County may have thereon and subject to the provisions of the Federal and State Soldier’s and Sailors’ Civil Relief Acts.

However, such tax liens shall have priority over the County’s Differential Interest Lien, representing the excess, if any, of the interest and penalty borne at the maximum rate over the interest and penalty borne at the rate at which the lien is purchased.

The Purchaser acknowledges that the tax lien(s) sold pursuant to these Terms of Sale may be subject to pending bankruptcy proceedings and/or may become subject to such proceedings which may be commenced during the period in which a lien is held by a successful bidder or the assignee of same, which may modify a Purchaser’s rights with respect to the lien(s) the property securing same. Such bankruptcy proceedings shall not affect the validity of the tax lien. In addition to being subject to pending bankruptcy proceedings and/or the Federal and State Soldiers’ and Sailors’ Civil Relief Acts, said purchaser’s right of foreclosure may be affected by the Financial Institutions Reform, Recovery and Enforcement Act (FIRREA), 12 U.S.C. ss 1811 et. seq., with regard to real property under Federal Deposit Insurance Corporation (FDIC) receivership.

The County Treasurer reserves the right, without further notice and at any time, to withdraw from sale any of the parcels of land or premises herein listed.

The rate of interest and penalty which any person purchases the tax lien shall be established by his bid. Each purchaser, immediately after the sale thereof, shall pay to the County Treasurer ten per cent of the amount from which the tax liens have been sold and the remaining ninety per cent within thirty days after such sale. If the purchaser at the tax sale shall fail to pay the remaining ninety per cent within ten days after he has been notified by the County Treasurer that the certificates of sale are ready for delivery, then all deposited with the County Treasurer including but not limited to the ten per cent theretofore paid by him shall, without further notice or demand, be irrevocably forfeited by the purchaser and shall be retained by the County Treasurer as liquidated damages and the agreement to purchase be of no further effect.

Time is of the essence in this sale. This sale is held pursuant to the Nassau County Administrative Code and interested parties are referred to such Code for additional information as to terms of sale, rights of purchasers, maximum rates of interest and other legal incidents of the sale.

Furthermore, as to the bidding,

- The bidder(s) agree that they will not work with any other bidder(s) to increase, maintain or stabilize interest rates or collaborate with any other bidder(s) to gain an unfair competitive advantage in the random number generator in the event of a tie bid(s) on a tax certificate. Bidder(s) further agree not to employ any bidding strategy designed to create an unfair competitive advantage in the tiebreaking process in the upcoming tax sale nor work with any other bidder(s) to engage in any bidding strategy that will result in a rotational award of tax

- The tax certificate(s) the Bidder will bid upon, and the interest rate(s) bid, will be arrived at independently and

without direct or indirect consultation, communication or agreement with any other bidder and that the tax certificate(s) the Bidder will bid upon, and the interest rate(s) to be bid, have not been disclosed, directly or indirectly, to any other bidder, and will not be disclosed, directly or indirectly, to any other bidder prior to the close of bidding. No attempt has been made or will be made to, directly or indirectly, induce any other bidder to refrain from bidding on any tax certificate, to submit complementary bids, or to submit bids at specific interest rates.

- The bids to be placed by the Bidder will be made in good faith and not pursuant to any direct or indirect, agreement or discussion with, or inducement from, any other bidder to submit a complementary or other noncompetitive

- If it is determined that the bidder(s) have violated any of these bid requirements then their bid shall be voided and if they were the successful bidder the lien and any deposits made, in connection with, said bid shall be

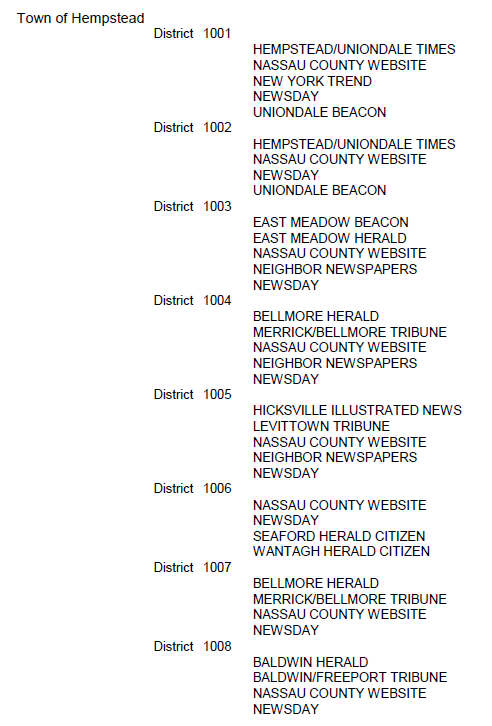

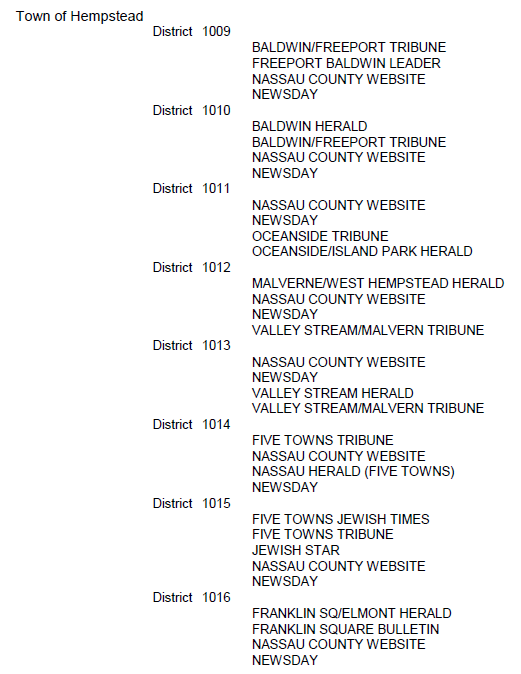

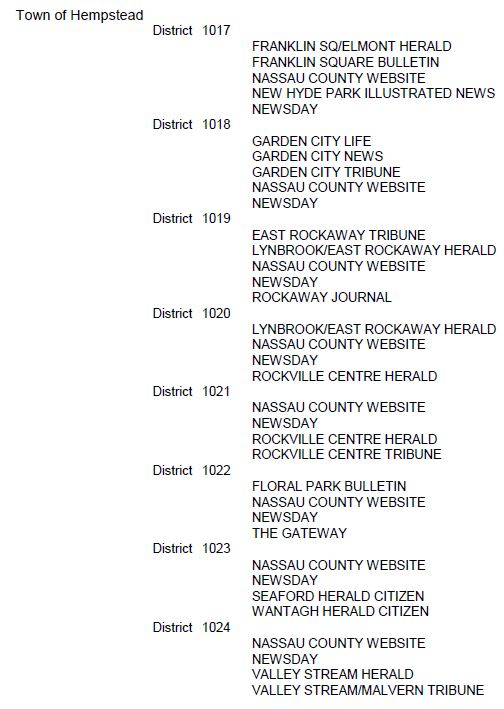

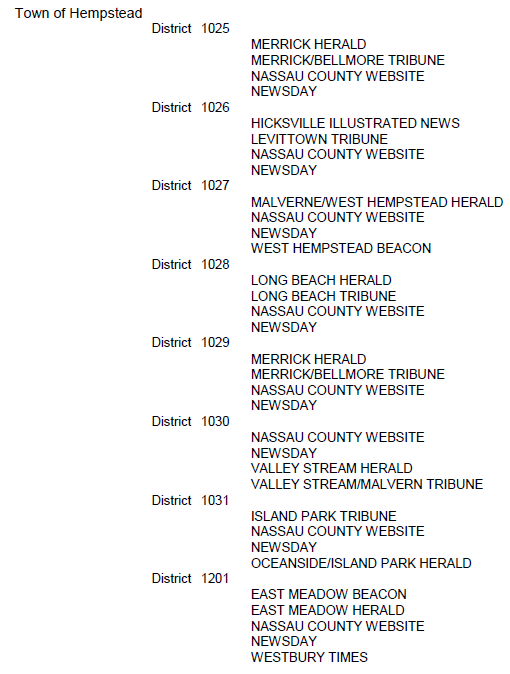

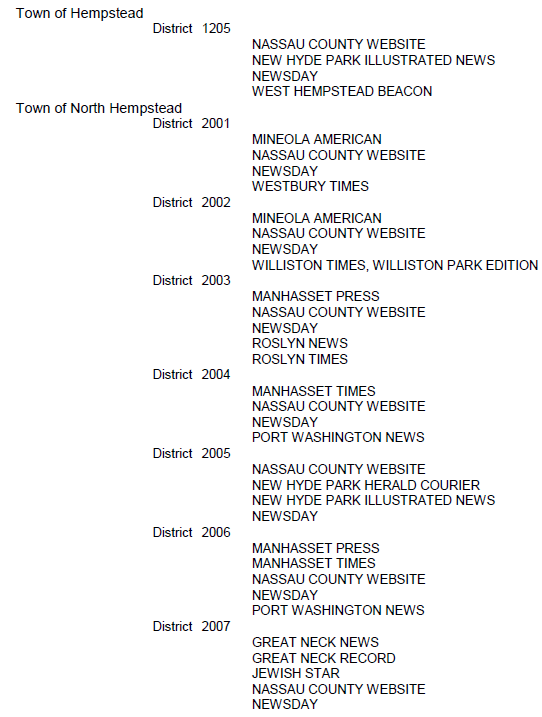

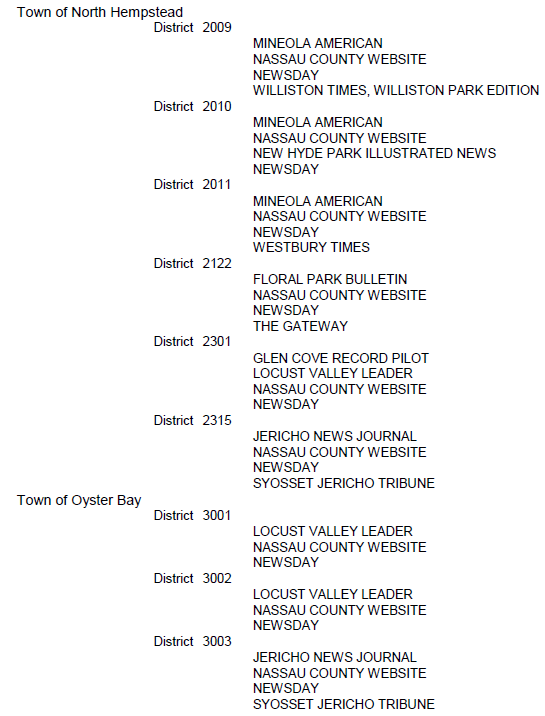

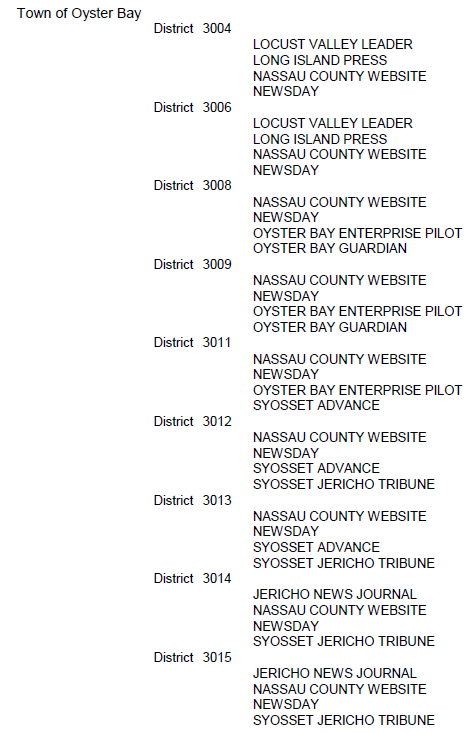

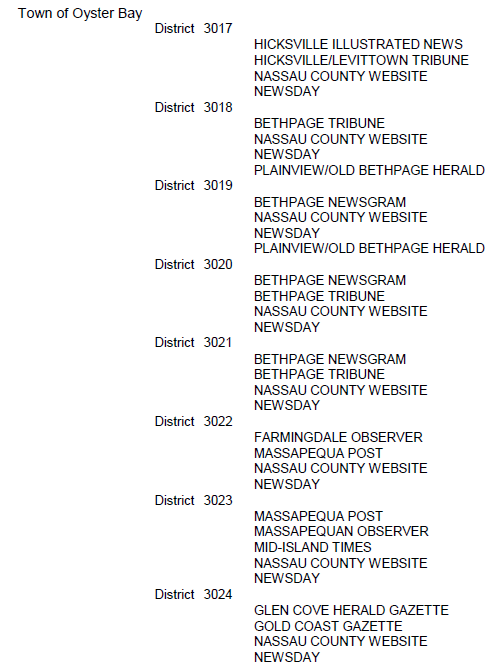

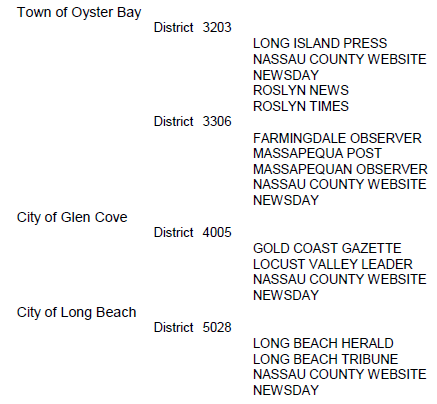

This list includes only tax liens on real estate located in Town of Oyster Bay. Such other tax liens on real estate are advertised as follows:

Nassau County does not discriminate on the basis of disability in admission to or access to, or treatment or employment in, its services, programs, or activities.

Upon request, accommodations such as those required by the Americans With Disabilities Act (ADA) will be provided to enable individuals with disabilities to participate in all services, programs, activities and public hearings and events conducted by the Treasurer’s Office. Upon request, information can be made available in braille, large print, audio tape or other alternative formats. For additional information, please call (516) 571-2090 ext. 13715.

Dated: January 17, 2020

THE NASSAU COUNTY TREASURER

MINEOLA, NEW YORK